Payment Plans

The Wellstar Health payment plan is designed to make healthcare costs more manageable for patients. It allows individuals to pay their medical bills over time instead of having to cover the full amount upfront. This can be particularly helpful for those facing unexpected medical expenses or those who may not have insurance that covers certain services.

When a patient option for a payment plan, they typically go through an application process where they provide information about their financial situation. This helps Wellstar determine the best plan for them, including how much they can afford to pay each month and the length of the repayment period.

Benefits of Wellstar Health Payment Plan

Wellstar Health offers various payment plans that can provide several benefits to patients, including:

1. Affordability: Payment plans can help spread out the cost of medical services over time, making it more manageable for patients to pay their bills.

2. Accessibility: By offering flexible payment options, Wellstar Health ensures that more patients can access the care they need without the burden of a large upfront payment.

3. Financial Clarity: These plans often come with clear terms and conditions, helping patients understand their payment obligations and avoid unexpected costs.

4. Reduced Financial Stress: By breaking down payments, patients can focus on their health rather than financial worries, potentially leading to better health outcomes.

5. Credit Management: Wellstar’s payment plans may help patients maintain or improve their credit scores by avoiding collections or late payment fees.

6. Personalized Plans: Many health systems, including Wellstar, offer customized plans based on individual financial situations, ensuring that payments align with what patients can afford.

7. Convenience: Many payment plans can be managed online, making it easy for patients to track payments and manage their accounts.

8. No Interest Options: Some plans may offer interest-free financing for a certain period, reducing the overall cost of care.

If you’re considering a payment plan, it’s a good idea to reach out directly to Wellstar Health for specific details and to see how they can tailor a plan to your needs.

How To Set Up A Payment Plan

This is the complete guidelines on how to set up a payment plan in Wellstar MyChart.

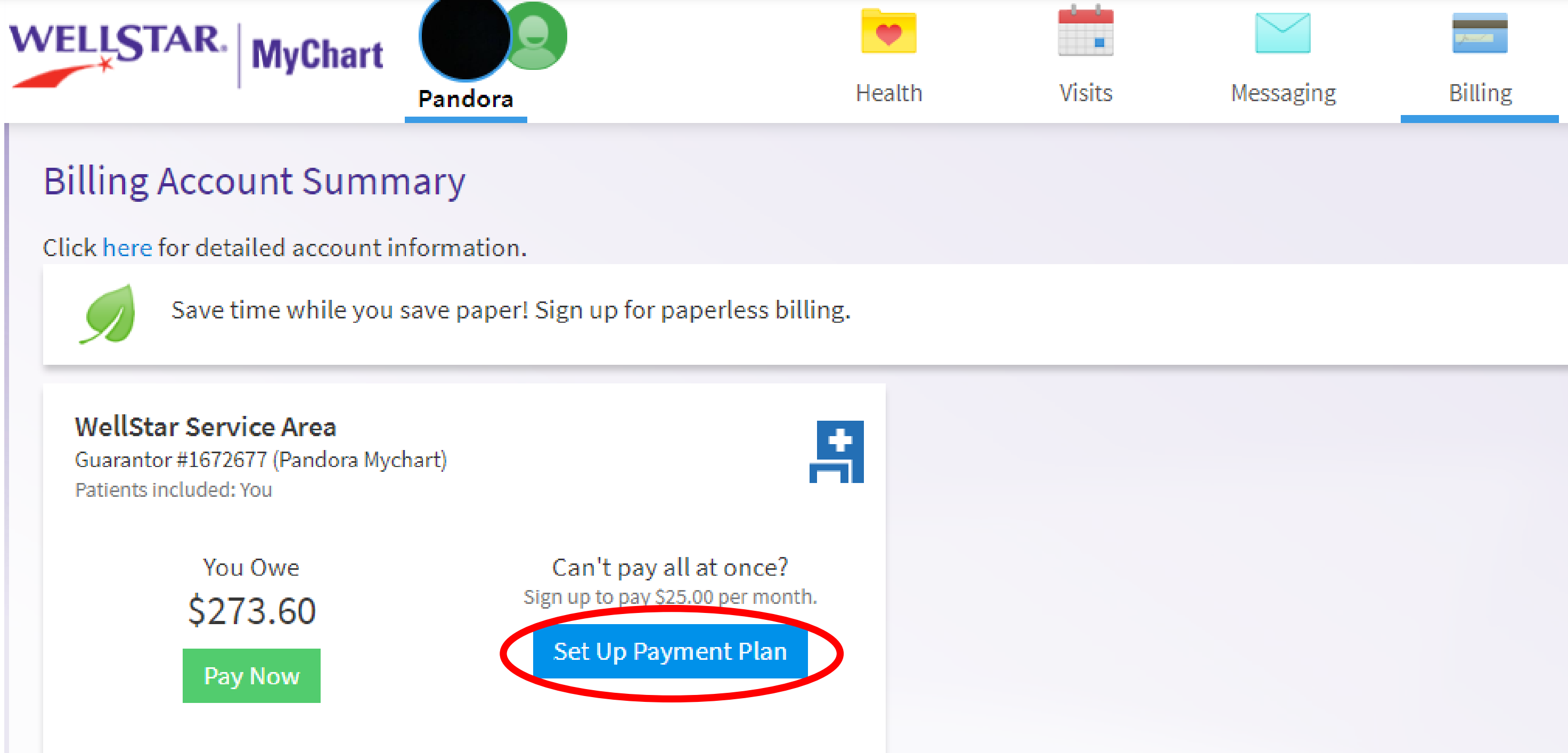

1. Login to your MyChart account and navigate to the “Billing” -> “Account Summary” menu

2. Select the account you are wanting to set up a payment plan for. If you don’t see the ‘Set Up Payment Plan’ option, your outstanding balance amount may not be eligible for a payment plan.

3. Complete the required information, select “Next”. The minimum amount is defaulted but can be adjust

4. If the amount entered does not fit the WellStar Payment Arrangement guidelines, the following error message will appear, and the minimum balance is defaulted in again

“The monthly payment you entered is too low for your outstanding balance. It has been automatically adjusted to the minimum allowed amount.

If you need further financial assistance, please call us at 1-470-245-9998”.

5. Continue entering payment information like a one-time payment

Please Note: If you need further assistance please contact the MyChart Service desk hours are Monday through Friday, 8:30 a.m. to 5:00 p.m.

Phone: 470-644-0419

Fax: 770-999-2306

Email: [email protected]

How Wellstar Health Offers Financial Assistance

Wellstar Health System’s vision is to deliver world-class healthcare to every person, every time. As a not-for-profit, we offer financial assistance so medically necessary healthcare is available to every person who needs it.

WellStar Health System is committed to providing financial assistance to patients who have sought medically necessary care at Wellstar Health System but have limited or no means to pay for that care. Wellstar will provide emergency medical care to all individuals, regardless of their ability to pay or eligibility under the Community Financial Assistance Policy.

In order to qualify for financial assistance, cooperation with Wellstar is necessary in identifying and determining alternative sources of payment or coverage from public and private payment programs.

Our financial Counselors are here to assist you:

- Request help from the government and local organizations.

- Request financial assistance and health insurance.

- Get care for free or at a reduced cost if you qualify.

- Examine long-term, interest-free payment plan possibilities.

For additional details about Financial Counseling or Financial Assistance and for application assistance, please contact Customer Service at 470-245-9998. You can also review your financial assistance (charity) application status via MyChart.